Stocks With the Highest Volume Accumulation Over the Last 10 Days

Spotting stocks with the highest volume accumulation in the last 10 trading days offers unique insight into where substantial market activity and potential bullish momentum are gathering. Volume accumulation over a short-term window like 10 days is often used by traders and investors to identify increased demand and strong participation, frequently signaling the possibility of a sustained move higher.

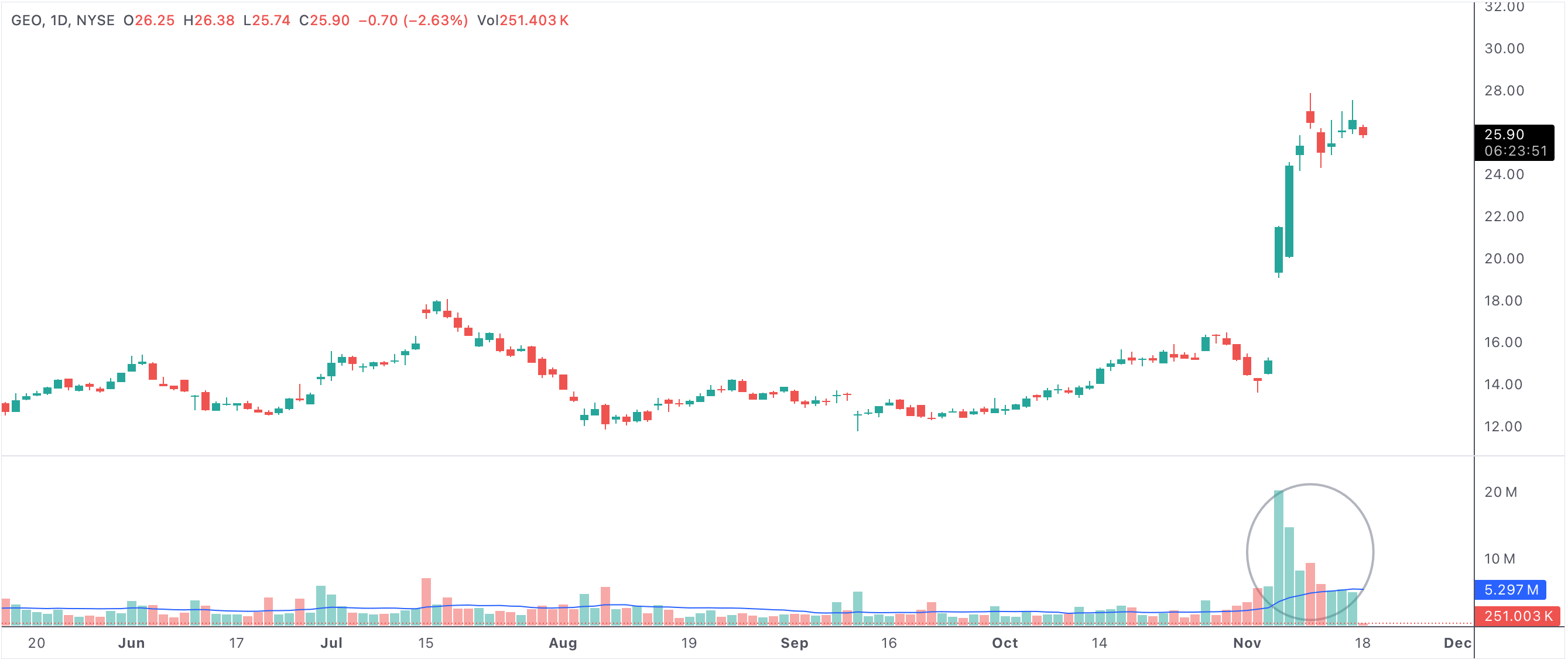

tendayvolumesurge

An example of a stock with the highest volume accumulation the last 10 days

Stocks with the highest volume accumulation the last 10 days

What Is Volume Accumulation and Why Does It Matter?

Volume accumulation refers to the persistent increase in a stock's traded volume, especially when accompanied by price gains or strong support levels. When a stock consistently registers above-average volume over several days, it typically indicates that large investors or institutions are actively acquiring shares, often in anticipation of future price strength or important news.

In technical analysis, high volume accumulation is regarded as a bullish indicator. The logic is straightforward: more buyers are stepping in, reflecting growing conviction and a willingness to absorb available supply. If this pattern persists for 10 days, it becomes increasingly difficult to dismiss as mere chance or short-term speculation.

Bullish Signals and Trading Strategies

Stocks with the highest 10-day volume accumulation frequently lead new market advances, particularly if the price is also breaking through resistance or setting new highs. This surge in activity acts as a confirmation that the uptrend is backed by real capital and not just fleeting interest.

For traders, these setups often warrant close monitoring for breakout entries. If a stock breaks above a well-established resistance level on unusually high volume, it can be a sign that a new uptrend is just beginning. Conversely, if the volume surge appears at a strong support level, it may indicate the start of a bullish reversal from a recent pullback.

Role of Institutional Buying and Investor Sentiment

Institutional investors typically operate in size, and their buying can be detected by studying volume surges that span several days. A 10-day streak of heavy accumulation rarely happens by accident; rather, it often signals that large funds are building positions discreetly. Such institutional support tends to attract additional buyers, including retail investors and momentum traders, further fueling price advances.

Investor sentiment also tends to shift more positively when high volume accumulation is detected, especially if it coincides with other technical indicators or positive news. The perception that "smart money" is entering a stock creates a feedback loop, driving even more interest and trading activity.

- 10-day volume accumulation is a reliable indicator of growing demand and bullish momentum.

- Price breakouts on strong volume frequently lead to lasting uptrends.

- Institutional activity is often behind persistent multi-day volume surges.

- Positive sentiment amplifies the move as more traders notice the trend.

- Breaks above resistance or strong support on heavy volume add further conviction.

How to Use Volume Accumulation in Your Analysis

To effectively utilize this signal, compare the 10-day volume accumulation with both the stock’s historical averages and current price action. A sharp uptick in volume alongside bullish price action suggests a high-probability move. Traders may look for confirming signals such as bullish candlestick formations, breakouts above resistance, or news catalysts.

Risk management is crucial: consider setting stops just below recent support if entering on a breakout. For longer-term investors, confirmation that accumulation is happening near key technical levels—like the 50-day or 200-day moving average—can be especially compelling.

Summary: Why 10-Day Volume Accumulation Matters

In summary, tracking stocks with the highest volume accumulation over the last 10 days is an effective way to spot early bullish momentum and potential institutional accumulation. These patterns often precede sharp moves higher, making them an essential part of any robust technical analysis toolkit. When paired with strong price action and positive market sentiment, high 10-day volume accumulation frequently leads to significant price advances and can help traders and investors gain an edge in the market.